Watch this short interview with GovernWith's Jennifer Dean and Fi Mercer to learn more about:

- Jennifer and her wealth of experience as a non-executive and executive Board Director, an actuary and financial services, superannuation and insurance industry executive with over 25 years experience.

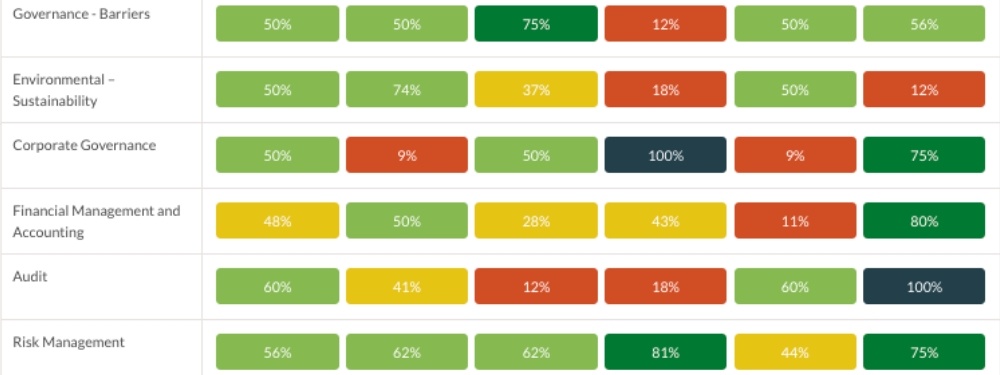

- The importance of self-led annual and externally-led evaluations for Financial Institutions

- The types of clients and organisations Jenny works with

- Jenny's role as a Financial Institutions Professional Advisor and Expert Convenor with GovernWith

- Some final tips and tricks for Financial Institutions looking to enhance their compliance and contemporary governance capability

{% video_player "embed_player" overrideable=False, type='hsvideo2', hide_playlist=True, viral_sharing=False, embed_button=False, autoplay=False, hidden_controls=False, loop=False, muted=False, full_width=False, width='1920', height='1080', player_id='186566034480', style='' %}

{% module_block module "widget_626b33e6-873e-4734-a03a-554457769d4d" %}{% module_attribute "child_css" is_json="true" %}{}{% end_module_attribute %}{% module_attribute "css" is_json="true" %}{}{% end_module_attribute %}{% module_attribute "definition_id" is_json="true" %}null{% end_module_attribute %}{% module_attribute "field_types" is_json="true" %}{"testimonials":"group"}{% end_module_attribute %}{% module_attribute "label" is_json="true" %}null{% end_module_attribute %}{% module_attribute "module_id" is_json="true" %}99618746242{% end_module_attribute %}{% module_attribute "path" is_json="true" %}"atlas-theme child/modules/Testimonials"{% end_module_attribute %}{% module_attribute "schema_version" is_json="true" %}2{% end_module_attribute %}{% module_attribute "smart_objects" is_json="true" %}[]{% end_module_attribute %}{% module_attribute "smart_type" is_json="true" %}"NOT_SMART"{% end_module_attribute %}{% module_attribute "tag" is_json="true" %}"module"{% end_module_attribute %}{% module_attribute "testimonials" is_json="true" %}[{"author":"Kathy Dickson","color_field":{"color":"#ffffff","opacity":100},"content":"\"After completing a full Board assessment and Governance Review, led externally by Jennifer Dean of GovernWith, the results have been outstanding. We now have a clear Action and Implementation Plan for the next two years. This provides reassurance for both the Board and Management, setting a strong foundation with clear objectives and expectations. Through our partnership with GovernWith, we’ve successfully integrated regulation and compliance — including preparation for ESG reporting — into a modern, user-friendly document that supports our Strategic Plan.\"","picture":{"alt":null,"size_type":"auto","src":""},"position":"CHAIR, FAMILY FIRST BANK"}]{% end_module_attribute %}{% module_attribute "type" is_json="true" %}"module"{% end_module_attribute %}{% module_attribute "wrap_field_tag" is_json="true" %}"div"{% end_module_attribute %}{% end_module_block %} {% module_block module "widget_96c6dbff-f98d-47a3-83f7-6ba4d1faa74a" %}{% module_attribute "child_css" is_json="true" %}{}{% end_module_attribute %}{% module_attribute "content" is_json="true" %}{% raw %}"